On the surface, bank earnings last week were not all that bad. JP Morgan, Goldman Sachs and Morgan Stanley posted great revenue numbers thanks to the money brought in through trading, but when you listen to commentary from the leaders at these companies, they do not paint a rosy picture.

"May and June will prove to be the easy bumps in terms of this recovery," Jennifer Piepszak, Chief Financial Officer at JP Morgan, said during the earnings call. "Now we're really hitting the moment of truth, I think, in the months ahead."

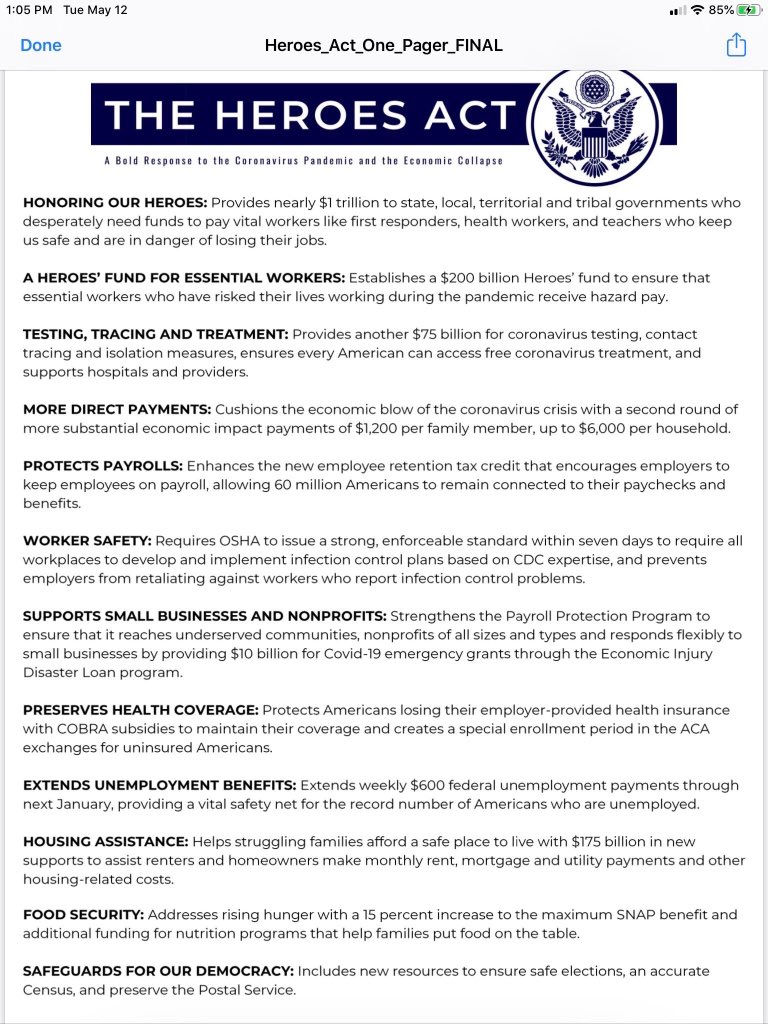

The CARES Act has put a Band-Aid over the economic crisis with expanded unemployment and a round of stimulus checks. People lost their jobs have still received sizable income because of the additional $600 the federal government tacked on to unemployment benefits.

The additional unemployment benefits expire by the end of the month. Congress could extend the initiative with the next stimulus bill, but they do not have a lot of time to come to an agreement on this legislation.

The importance of the beefed up benefits came up during multiple earnings calls with banks.

"In the normal recession, unemployment goes up, delinquencies go up, charge-offs go up, home prices go down," Jamie Dimon, Chairman and Chief Executive Officer at JP Morgan, said during the earnings call.

"Savings are up, incomes are up, home prices are up."

Executive at Bank of America also noted that they have not seen consumer spending drop off, as expected, during a typical recession.

"We are seeing nothing that is consistent with an 11% unemployment rate in the actual consumer payment behavior," Brian Moynihan, Chief Executive Officer at Bank of America, said.

Banks are not seeing people miss credit card bills or loan payments at what they had initially expected when the pandemic hit the U.S. The expanded unemployment benefits have allowed people who lost jobs to pay their bills.

If Congress does not pass another massive stimulus plan with boosted unemployment benefits, I would anticipate people have a tougher time covering some of their bills.

The other issue has to do with the virus itself. Unfortunately, COVID-19 cases are rising in the U.S. and this has caused a majority of states to either pause or roll back their reopening plans.

"With an increase in viruses and this uncertainty persisting, I think you'll see a flattening in that economic pickup, and that will slow the progress we make economically from here," David Michael Solomon, Chairman and Chief Executive Officer at Goldman Sachs, said during their earnings call.

"We continue to advise clients to be thoughtful and cautions about that." Another concerning takeaway from bank earnings came from Wells Fargo. The business reported its first loss since 2008, and executives said they want to cut $10 billion in costs. "We're going to reduce our expenses by a certain point in time because we are doing the work to figure out what the timing looks like with our reductions versus our investments," Charlie Scharf, Chief Executive Officer at Wells Fargo, said. When companies want to really slash expenses, they lay employees off, and if Wells Fargo cuts jobs, it makes it easier for other large businesses to do the same. As business leaders look ahead to 2021, how many of them are making plans to reduce staffing so they can find the "right size" for their companies? We could see a second wave of job losses later this year, and we probably will not have expanded unemployment benefits for the newly laid off to rely on.